Forget stuffy bank branches and endless paperwork. The future of finance is here, and it’s powered by artificial intelligence. AI is no longer a futuristic fantasy; it’s quietly revolutionizing the banking industry, transforming everything from how we manage our money to how institutions fight fraud. This powerful technology is making banking more efficient, personalized, and secure than ever before. But this revolution isn’t without its challenges. Join us as we explore the exciting world of enterprise AI in banking and finance, uncovering the incredible benefits, navigating the potential pitfalls, and ultimately, discovering how this technology is reshaping the future of money.

AI’s Winning Hand: Benefits for Banks and Customers Alike

So, how exactly is AI shaking up the financial world? Let’s break down some of the key benefits:

For the Banks:

Supercharged Efficiency: AI automates tedious tasks like data entry, loan processing, and risk assessment, freeing up human employees for more complex and strategic work. This translates to reduced operational costs and increased productivity.

Fraud Fighter Extraordinaire: AI algorithms can analyze massive datasets in real time, detecting suspicious transactions and patterns that might indicate fraud. This proactive approach helps banks protect both themselves and their customers from financial losses.

Risk Management Guru: AI can assess creditworthiness, predict market volatility, and optimize investment portfolios with greater accuracy than traditional methods, leading to better risk management and more informed decision-making.

Personalized Customer Experiences: AI powers chatbots, virtual assistants, and personalized recommendations, providing customers with 24/7 support and tailored financial advice. This leads to increased customer satisfaction and loyalty.

For the Customers:

Banking at Your Fingertips: AI-powered mobile banking apps provide a seamless and intuitive user experience, allowing customers to manage their finances anytime, anywhere.

Personalized Financial Guidance: AI can analyze your spending habits, financial goals, and risk tolerance to offer personalized advice on budgeting, saving, and investing.

Proactive Security: AI helps protect your accounts from fraud by identifying suspicious activity and alerting you in real time.

Faster, More Efficient Service: AI streamlines processes like loan applications and customer support, reducing wait times and improving overall efficiency.

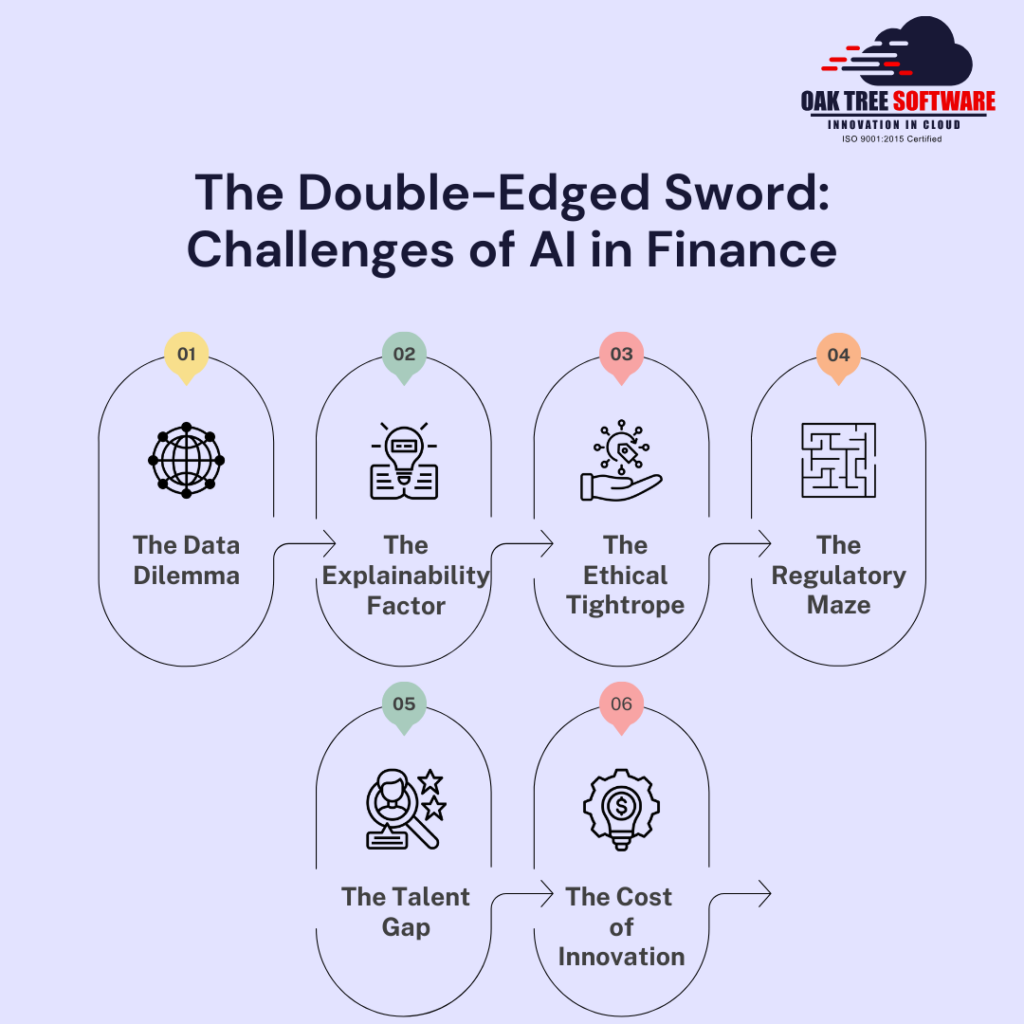

The Double-Edged Sword: Challenges of AI in Finance

While AI offers a wealth of opportunities for the banking and finance sector, it also presents some significant hurdles that need to be addressed:

The Data Dilemma: AI algorithms are only as good as the data they are trained on. Inaccurate, incomplete, or biased data can lead to flawed outcomes, inaccurate predictions, and even discriminatory practices. Ensuring data quality and fairness is crucial for responsible AI implementation.

The Explainability Factor: Many AI algorithms, particularly deep learning models, are “black boxes” – they provide outputs without explaining the reasoning behind them. This lack of transparency can make it difficult to understand why a loan application was rejected or a particular investment was recommended, raising concerns about accountability and trust.

The Ethical Tightrope: AI raises ethical concerns around data privacy, algorithmic bias, and the potential for job displacement. Financial institutions need to ensure they are using AI responsibly and ethically, with clear guidelines and safeguards in place.

The Regulatory Maze: The rapidly evolving nature of AI presents challenges for regulators who need to keep pace with the technology and develop appropriate frameworks to ensure its safe and ethical use.

The Talent Gap: Implementing and managing AI solutions requires specialized skills and expertise. There is a growing demand for data scientists, AI engineers, and other skilled professionals who can develop, deploy, and maintain these systems.

The Cost of Innovation: Developing and deploying AI solutions can be expensive, requiring significant investments in infrastructure, software, and talent. Smaller institutions may face challenges in keeping up with the rapid pace of innovation.

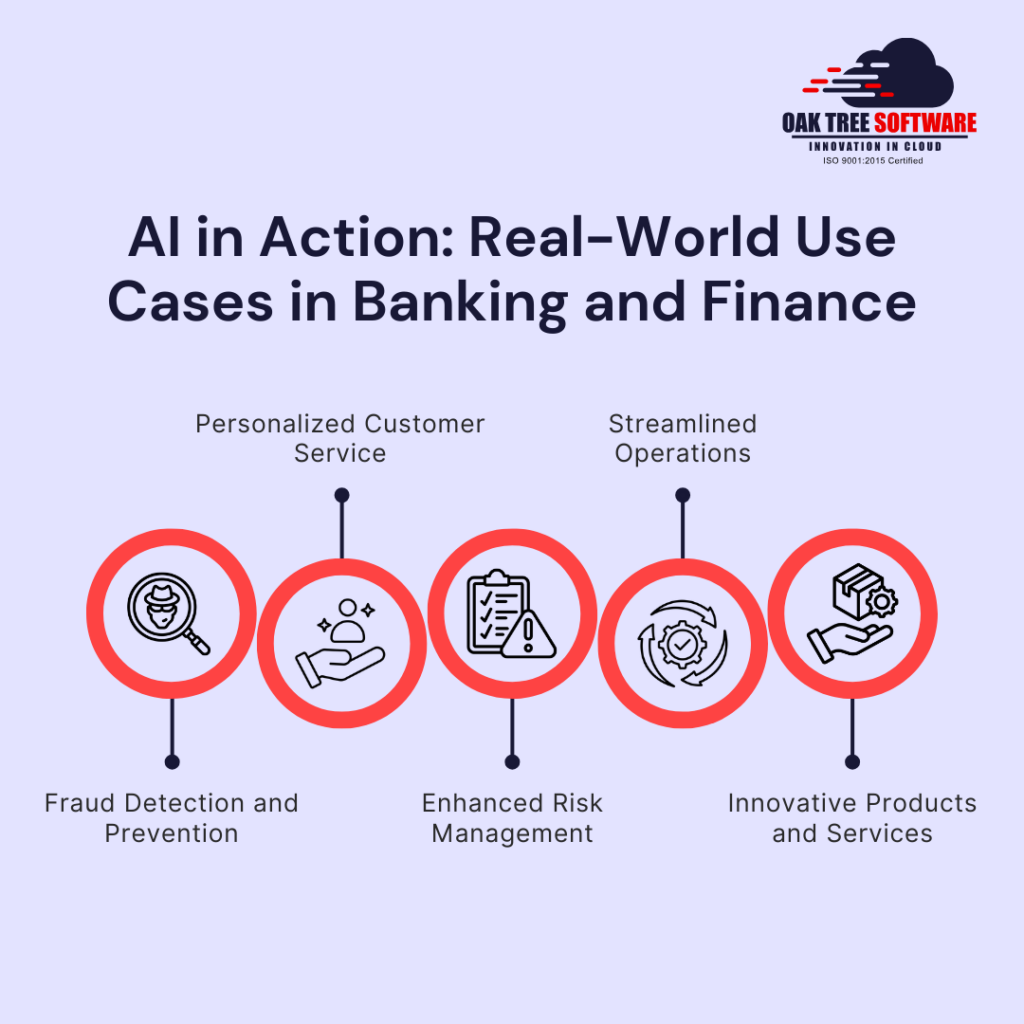

AI in Action: Real-World Use Cases in Banking and Finance

AI is already making a tangible impact on the banking and finance industry. Here are some compelling examples of how this technology is being used:

1. Fraud Detection and Prevention:

Real-time transaction monitoring: AI algorithms analyze millions of transactions per second to identify suspicious patterns and flag potentially fraudulent activity, preventing losses for both banks and customers.

Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance: AI helps automate identity verification and compliance checks, ensuring regulatory requirements are met efficiently.

2. Personalized Customer Service:

AI-powered chatbots: Virtual assistants provide 24/7 customer support, answer frequently asked questions, and guide users through basic banking tasks.

Personalized recommendations: AI analyzes customer data to offer tailored financial advice, product recommendations, and investment strategies.

3. Enhanced Risk Management:

Credit scoring and loan assessments: AI algorithms analyze a wider range of data points to assess creditworthiness more accurately and efficiently, leading to faster loan approvals and reduced risk for lenders.

Algorithmic trading and portfolio management: AI-powered systems analyze market trends and execute trades at optimal times, maximizing returns for investors.

4. Streamlined Operations:

Process automation: AI automates repetitive tasks such as data entry, document processing, and customer onboarding, freeing up human employees for more strategic work.

Predictive maintenance: AI helps predict equipment failures and maintenance needs, reducing downtime and improving operational efficiency.

5. Innovative Products and Services:

Robo-advisors: AI-powered platforms provide automated investment advice and portfolio management, making investing accessible to a wider audience.

Personalized insurance: AI analyzes individual risk profiles to offer customized insurance policies at competitive prices.

These are just a few examples of how AI is transforming the banking and finance landscape. As the technology continues to evolve, we can expect even more innovative applications to emerge, further revolutionizing the industry and shaping the future of money management.

Oaktree Software: Transforming Finance with Tailored AI Solutions

Oaktree Software acts as your true AI Software Development partner in innovation, bringing the power of AI directly to your fingertips without the need for complex platform installations. Think of them as your AI strategists and implementers, crafting bespoke solutions tailored to your specific needs and challenges. Whether it’s enhancing your fraud detection capabilities with cutting-edge algorithms, building a personalized recommendation engine to delight your customers, or automating tedious tasks to free up your team, Oaktree’s expertise guides you every step of the way. With their support, you can seamlessly integrate AI into your existing infrastructure, unlock the true potential of your data, and propel your institution to the forefront of the AI-driven financial revolution.

Conclusion

The future of finance is undoubtedly intertwined with AI. By embracing this technology and partnering with experts like Oaktree Software, financial institutions can unlock new levels of efficiency, innovation, and customer satisfaction. Don’t just keep up – leap ahead and shape the future of finance with AI.

FAQ’s

1. What is enterprise AI and how is it different from regular AI?

Enterprise AI refers to the application of artificial intelligence to solve specific business challenges within an organization. In the context of banking and finance, this means using AI to improve efficiency, reduce costs, manage risk, and enhance customer experiences. It differs from regular AI in its focus on practical applications and integration with existing systems and processes.

2. How can AI improve the customer experience in banking?

AI can personalize the banking experience by offering tailored product recommendations, providing 24/7 support through chatbots, and streamlining processes like loan applications and account openings. This leads to increased customer satisfaction and loyalty.

3. Is AI going to replace human jobs in banking?

While AI will automate certain tasks, it’s more likely to augment human roles rather than replace them entirely. Employees will be freed from repetitive tasks and can focus on more complex and strategic work that requires human judgment and interaction.

4. How is AI used to detect fraud in banking?

AI algorithms can analyze massive datasets of transactions in real time, identifying suspicious patterns and anomalies that may indicate fraudulent activity. This allows banks to proactively prevent fraud and protect both themselves and their customers.

5. What are the ethical concerns surrounding AI in finance?

Ethical concerns include data privacy, algorithmic bias, and the potential for job displacement. It’s crucial for financial institutions to use AI responsibly and transparently, with clear guidelines and safeguards in place.

6. How can banks get started with implementing AI?

Banks can start by identifying specific areas where AI can add value, such as fraud detection, customer service, or risk management. Partnering with experienced AI providers like Oaktree Software can provide access to the necessary expertise and technology for successful implementation.